Life Insurance in and around El Paso

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

Do you know what funerals cost these days? Most people aren't aware that the typical cost of a funeral nowadays is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If the people you love cannot pay for your funeral, they may fall on hard times in the wake of your passing. With a life insurance policy from State Farm, your family can maintain their quality of life, even without your income. Whether it pays for college, maintains a current standard of living or keeps paying for your home, the life insurance you choose can be there when it’s needed most by your loved ones.

Coverage for your loved ones' sake

Life happens. Don't wait.

Their Future Is Safe With State Farm

You’ll get that and more with State Farm life insurance. State Farm has fantastic coverage options to keep your family members safe with a policy that’s modified to accommodate your specific needs. Fortunately you won’t have to figure that out alone. With strong values and excellent customer service, State Farm Agent Terry Chaumont walks you through every step to build a policy that protects your loved ones and everything you’ve planned for them.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to explore what a company that processes nearly forty thousand claims each day can do for you? Reach out to State Farm Agent Terry Chaumont today.

Have More Questions About Life Insurance?

Call Terry at (915) 856-1200 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

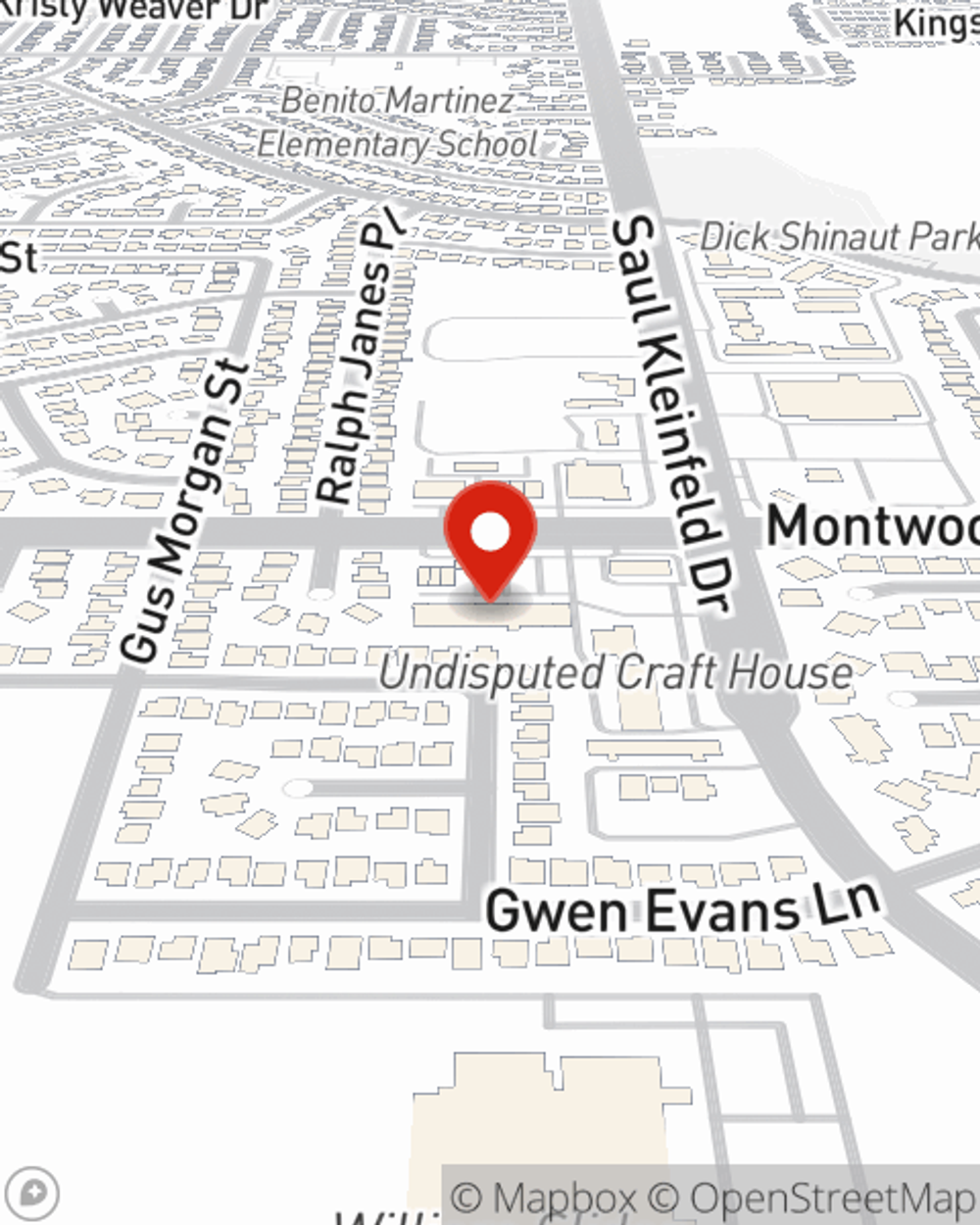

Terry Chaumont

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.